In today’s world of payments, speed matters.

Consumers increasingly expect faster everything, demands that are driven by the proliferation of peer-to-peer (P2P) payments enabling individuals to quickly send money to a friend or pay for products and services. The access, speed and convenience of faster or real-time payments are becoming the norm — that means greater opportunity for financial institutions to differentiate the money movement experiences they deliver to their customers. One area slower to initiate real-time speed is in traditional account-to-account, or A2A, transfers.

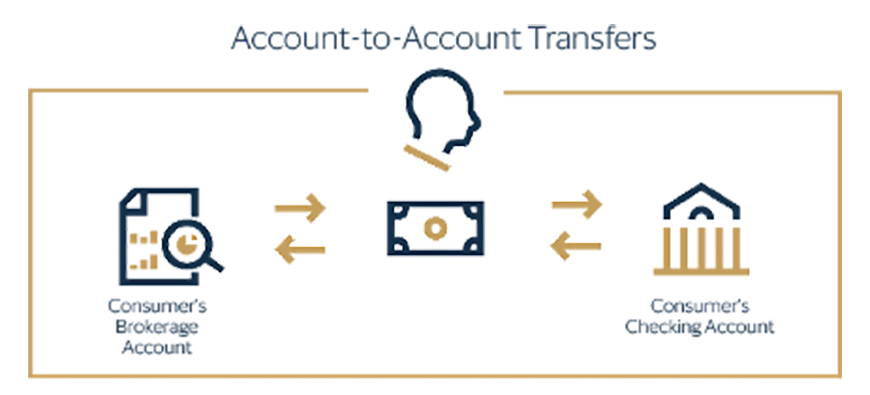

A2A transfers happen when a customer transfers funds between their own accounts (brokerage, crypto, savings and checking) held at two different financial institutions: for example, transferring funds from a savings or brokerage account to a separate checking account. Too often, consumers must rely on outdated processes such as traditional Automated Clearing House methods that can take days to complete, ultimately impacting time-sensitive investment opportunities and on-time bill payments.

“Today, consumers are accustomed to being able to quickly send money to friends and family using various P2P payment platforms. But moving money between your own accounts is still a lengthy and inefficient process,” says Yanilsa Gonzalez-Ore, senior vice president, North America head of Visa Direct.

Surveyed U.S. consumers own, on average, 8 financial accounts and conduct 15 transactions between them a year, accounting for $3 trillion in annual money movement via A2A transfers, according to a survey by Visa and Aite Group. This diffusion of their financial picture can result in the subsequent need to optimize finances and investments across those accounts — compounded by the desire and expectation that they can do it with ease anytime, anywhere.

We also found that 90% of surveyed U.S. consumers want the flexibility of real-time transfers between their financial accounts. And 70% of surveyed U.S. consumers said they prefer card-based real-time payments for transfers.

“Two factors that are driving customer demand today are user interface simplicity and real-time money movement,” says Gonzalez-Ore. “Disrupting the A2A space and delivering real-time payments can be a win-win for any financial institution. You may receive deposits faster, and in turn, you’ll potentially see higher retention from those clients by meeting their demand. There are potential benefits for everyone in the ecosystem.”

Younger demographics tend to be a step ahead when it comes to technology adoption and digital experiences. Quick gratification is the expectation for millennial and Generation Z customers. This matters now because there will likely be an overall demographic shift in the U.S., propelled by a transfer of wealth across generations. Banks should think about how they can expand their own money movement offerings in the ever-changing payments landscape.

“We will likely see more and more demand for faster, more seamless transfers and transactions,” says Gonzalez-Ore.