Businesses rely on banks for the capital they need to grow, but that capital is locked behind mountains of paperwork.

Although now mostly digitized, all of this digital paperwork is largely processed manually, which increases costs, constrains volume, slows transactions and frustrates everyone.

Our team at Able has spent hundreds of hours on-site with commercial lenders, observing their credit delivery processes from start to finish. Most of these lenders employ highly paid team members who spend up to half their workdays doing paperwork that could easily be automated. At the same time, these lenders are struggling to hire and retain the workforce they need to handle any increase in volume. On the other end of the transaction, we routinely find borrowers who compare the paperwork process to “pulling teeth,” “a prostate exam” and “open-heart surgery.”

The root cause of all these problems is the same thing: paperwork. That’s where artificial intelligence (AI) comes in. Lenders can use AI to improve both efficiency and experience in one fell swoop.

Lenders can use AI to collect documents automatically. AI can create document checklists and all of the messaging needed to collect those documents. When a borrower returns the documents, the system can name, index and organize all of the documents, while keeping shared checklists up to date. It’s a much more pleasant experience for everyone. There’s very little manual work to do, saving time for borrowers and lenders alike. It also minimizes the possibility of filing errors that can cause costly problems down the line.

The benefits of AI go beyond onboarding. Once the AI has organized all of the documents, lenders can search for important information like names and dates as quickly and easily as searching Google.

As AI increases efficiency, the savings can add up quickly. Document checklists, for example, are one of many processes that repeat over and over throughout the credit life cycle. When lenders reduce the cost and time needed to create a checklist, they’ll save every time that process repeats. Multiply those saving times all of the loans processed in a year and the savings can quickly climb into the 7-figure range.

But isn’t AI risky? No, not with the right guardrails in place. Lenders will need to implement sound model governance policies to mitigate model errors, bias, and data drift. There are many technical controls that vendors and IT teams can perform to achieve this. One approach is a system called human-in-the-loop training, which relies on feedback from experts to approve or modify inferences made by the system. This setup allows models to minimize both human and model errors while learning as organizational rules change over time.

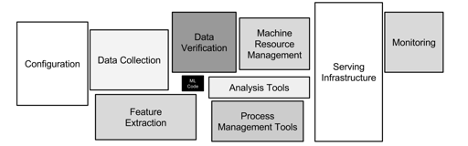

The main drawback of AI for lenders is the cost of building, training and monitoring a production-grade AI system. Even with recent advancements, getting a new AI system up and running safely requires a significant upfront investment. For any one AI model — even one leveraging off-the-shelf technology like Alphabet’s Bard or OpenAI’s ChatGPT — the model (the black box in the figure below) needs to be accompanied by a much larger and expensive suite of tools to ensure its reliability and quality in a production setting.

D. Sculley et al. (Google). Hidden Debt in Machine Learning Systems Neural Information Processing Systems, Proceedings. 2015.

That kind of investment and time horizon would probably be difficult for most banks to prioritize, which makes outside vendors a good option. These outside vendors have an advantage not only in resource investment but also in training data. Why? Vendors that serve multiple high-volume lenders can accrue training data while maintaining strict privacy and compliance guidelines much faster than any single bank can on its own. The more data the system has, the faster it learns, the better it gets, the greater the savings. Everyone benefits as a result.

When I say “everyone benefits,” that includes the workforce. Some believe AI is out for our jobs. I believe that AI is out to change our jobs. Remember those employees I mentioned, the ones who spend half their day doing work that could be automated? Do you know how happy they are now that we’ve automated that work for them? They’re thrilled. They get to spend less time doing the same thing over and over. Who wouldn’t be happy about that?

I know that, for many of you, AI sounds far off in the future. But it’s here, in banks, delivering efficiency and experience gains today. AI will make lenders more competitive, agile, scalable and accessible. We’ll all be better off for it.